Whether it’s your first investment property or your fortieth, running the numbers on a deal is vital. Having a clear picture of those figures not only helps you make a strong offer with confidence (important in today’s market), but it can also provide you with a game plan for your first 12-24 months of ownership.

For example, maybe after reviewing the numbers you see that the current rents are far below market value. Not only will this indicate you can potentially raise your offer price to be more competitive, but it will provide you with clear first steps for when you own the property (raise the rents and/or seek new tenants).

“But where do I begin?” you ask?

We’ve taken a lot of the calculations out of the equation. You can access your own copy of our fast and easy deal analysis calculator below.

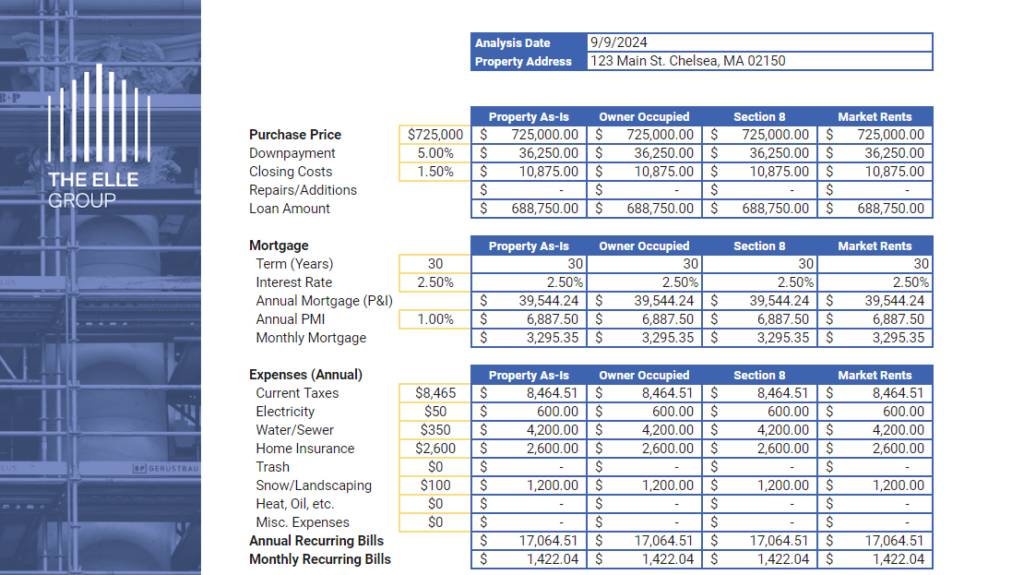

Let’s start up top with the “Purchase Price” information. Fill out the boxes outlined in yellow, and the Sheet will do the rest. What do you plan to offer for this property? How much do you plan on putting down? What about closing costs (1.5% is a safe estimate if you aren’t sure of the exact figure)?

Now let’s move down to the “Mortgage” section. Once again we’ll be filling out the yellow boxes. Due to interest rates being so low, it’s typically advised to stretch your loan out for as long as possible. In this case, 30 years. As for the “Interest Rate” and “Annual PMI,” that information will typically be provided to you by your lender. If you haven’t yet spoken to a lender, you can get a good estimate of current rates here, and for Annual PMI, that’ll typically only apply if you are putting less than 20% down for your down payment.

TTo truly get a good understanding of the investment you’re about to make, there are additional expenses to consider than just your mortgage payment. Here in the “Expenses (Annual)” section, we’ll cover nearly all of them. Going line by line:

Current Taxes: This number will likely be provided on the listing right from Zillow, Redfin, or the likes. It’s best to round up on this number as the town will likely reassess the property once it changes hands.

Electricity: If this is a multi-family property, are the utilities separated? Can you pass those expenses directly on to the tenants? Even so, there will likely be a “common area” utility bill for you, the landlord, to cover. The listing agent should be able to provide you with a summary of the past 12 months of utility bills if requested.

Water/Sewer: Similar to the electricity line item, your multi-family property may have separate water meters which will allow you to pass on these bills to your tenants. Once again, the listing agent should be able to provide a history of these expenses upon request.

Home Insurance: This can vary quite a bit depending on the property, the owner, and the coverage needed/requested. This article here may be able to shine a more detailed light on the topic. That being said, the listing agent should once again be a great resource for when you get more serious about an offer letter.

Trash: Does the local municipality charge for trash removal? Most do, but not all. A great resource to check is the town’s website or clerk’s office (or again, the listing agent!).

Snow/Landscaping: Will this property require a lot of maintenance during the Summer/Winter months? Or is it part of an association where your fees have this covered? Alternatively, you can broker an arrangement with one of your tenants to take care of the lawn/snow removal in exchange for reduced rent.

Heat, Oil, etc.: You’ll want to take a look at how this property is heated (hot water heaters, too!). Once again, are these utilities separated for each unit? Can these costs be passed off to your tenants? Or are there some common areas you’ll have to account for yourself? At the risk of sounding like a broken record, once again, you can consult with the listing agent for a history of these expenses.

Misc. Expenses: Anything else to consider? Any other information in the property listing that alludes to additional expenses, such as a Homeowners’ Association fee (typically seen with condos)?

As great as it would be to stop there for expenses, it’s worth considering the additional, longer-term expenses you are bound to experience as a buy-and-hold real estate investor. We’ll start with “Expected Vacancy,” which, as the name suggests, builds in a predictable percentage of vacancy throughout your ownership. This will likely range from 1-5% depending on the location of the property. Highly desirable areas with low inventory, such as Boston, typically can afford to account for just a 1% rate here. Next we’ve got “Management Fee” which should be quite straightforward; do you plan on self-managing the property, or outsourcing the responsibility to a management company? If you plan to do it yourself, enter 0%; if you intend to use a management company, you can use 5-10% depending on the location of the property. Lastly, we have “Maintenance.” Here’s where we account for the general upkeep and maintenance of the property. For example, every 20-30 years you know you’ll need to replace the roof, every 5-6 years you may replace the water heaters, and so on. A good ballpark for this row is somewhere between 5-8%.

Now to the fun part, the income. Oftentimes the current rents (if applicable) are shown within the listing documentation. This information may prove useful, or as mentioned previously, it may be drastically off from where the true market rents should be. A qualified Realtor (read: The Elle Group) can run accurate comps for you leveraging MLS data. However, if you’re looking to do this on your own, take a look on Zillow or other online directories to see what similar properties are renting for. Be sure to compare true like-for-like properties for the best results.

If you’re interested in seeing what your property can rent for with Section 8 tenants, your local municipality should have a database online that shows the number of bedrooms in a unit, and the maximum amount of rent you can receive from the program. Here’s an example of that report for all of Greater Boston. *Note that you can’t automatically charge the maximum rate for your unit; it must actually warrant that via market rates in the area.

Now that all your information has been compiled, you can review the calculations on the bottom of the sheet as well as the “Calculator” tab to see the full 30+ year results. One note that’s worth considering: if you’ve listened to a number of real estate-related Podcasts, you’ve probably heard a lot of guests talking about “Cash on Cash Returns” and their personal standards for investing. Some guests may only touch properties with >12% CoC returns, while others may be satisfied with 5%. It all comes down to their investment style as well as the local markets in which they are investing. A small single-family home in the Midwest may have great CoC returns, but their rate of appreciation will likely be very low. Inversely, a multi-family in Dorchester, MA is likely to have a CoC rate closer to 5%, but much stronger appreciation, which as you’ll see in the 30+ year calculations, can pay off massively.

Still not quite sure where to start? That’s what we’re here for! Use the contact form below to schedule some time on our calendar and we’ll walk you through step-by-step on how to acquire your first (or fortieth) investment property.